CEO/Co-Founder LaVerne Cox and Managing Director R.J. Cox discuss the wealth growth that homeownership provides. In the Inaugural Episode, you’ll hear a real estate market update (covering current interest rates, housing inventory, rental prices, foreclosures, and top hot markets in the US), you’ll learn more about why people choose to invest in real estate, you’ll discover a unique way to make money with your home called “house hacking,” and we’ll debunk some common homeownership and real estate investing misconceptions. LaVerne and R.J. also discuss Evergreen Investments’ position as “The Missing Middle Advisor” and how Evergreen Investments supports money-making moves through residential real estate.

Transcript:

Krista Westfall:

All right. Well, let’s get started then. A few people will probably be jumping in throughout. We will be recording the whole webinar so they won’t miss out on anything. So hello, everybody. Thank you for joining us today. My name is Krista Westfall. I am the marketing director at Evergreen Investments, and I will be your moderator today. First and foremost, I’d like to welcome you all to Evergreen Investments’ very first webinar. [00:00:30] We are so excited to begin this webinar journey with you all to teach homeowners how to uncover ways to make money, to save money and to invest money in residential real estate. Homeownership is the number one way to grow wealth in America. And our goal with these regular webinars is to educate you, to inform you and to guide you towards wealth generation strategies that are very unique to homeowners.

Today. You’ll be hearing from Evergreen Investments’ leadership.[00:01:00] We have LaVerne Cox, CEO and co-founder, and we have RJ Cox managing director, and co-founder. LaVerne and RJ bring a combined 40 plus years of experience in real estate, finance, entrepreneurship, and asset management. Today LaVerne and RJ are going to be focusing on making money with residential real estate. With that, we have an exciting agenda for you today. We’re going to kick things off with an industry update. The real estate market [00:01:30] is ever-changing. If you have been paying attention at all in the last couple of years, you definitely know that. So we just wanna make sure that we keep you in the know of what’s going on in the current market. Then we’ll move on to a little background on why people choose to invest in home ownership, and we’ll have a conversation about the mindset necessary to begin making money with your home. And we’ll present a unique way to create cash flow with your current home, with a strategy known as house hacking from there, we’ll do a quick intro to Evergreen [00:02:00] Investments and fill you in on how we’re supporting homeowners throughout their entire homeownership journey and how we’re helping people reach their financial goals. At the end, we’ll have LaVerne and RJ answer some hot questions we’ve been getting from our clients. If you have any questions at any point during this conversation, please feel free to drop them in the chat box. After our webinar, our hosts will be doing an AMA, ask me anything type format, and we’ll be sending out the detailed answers through email later [00:02:30] this week. If you miss something important or you wanna refer back to what we talked about today, no worries. You will be getting a recording of this webinar straight to your email box after we close. So before we jump in, we’d like to start off with a poll. We’ve been hearing some concerns about the current real estate markets. We want to hear from you and what your biggest concern is with the current real estate market. So we’re gonna fire up that poll. It should show up on your screen.

[00:03:00] All right. What is your biggest concern in today’s real estate market? Interest rates, home prices, talks of a housing crash, or you do not have any concerns. Please vote now. Okay. Home prices and talks of a housing crash are a popular answer here, talks of a housing crash home prices, interesting, pretty half-and-half with those. [00:03:30] Interest rates, there’s of over interest rates. It looks like there’s nobody who has no concerns in this webinar today. So hopefully we can kind of help alleviate some of those concerns for you today. The big winner here was talks of a housing crash. Nearly half of you chose that as your answer. Very interesting. All right. Now, without further ado, I will turn the time over to LaVerne and RJ who are going to start you off with a quick real estate market update. [00:04:00] LaVerne, why don’t you talk to us a little bit about what you’re saying about interest rates?

LaVerne Cox:

Well, thank you very much, Krista. Good afternoon, everyone. On the topic of interest rates, there have been numerous headlines in regards to the fed raising interest rates, three-quarters of a percentage point in the past week. RJ, would you like to share how that fed interest rate actually surprisingly [00:04:30] did not affect the mortgage interest rates?

R.J. Cox:

Yeah, that’s interesting. And even though the fund, the fed fund rate rose, the mortgage rates fell and since mortgage rates tracked the 10 year treasury note and at the end of July, that tanked. So the 30-year fixed mortgage rate went down to 5.22% and that’s down 32 basis points from June’s high of 6%. So for buyers that [00:05:00] were concerned that they lost out on the best of it all, it looks like they’re getting a little bit of rate relief and bringing some more folks back out that had previously thought they were going to be out of the purchasing market inventory. However, is coming back up nationally. We are looking at 18.7% using a year-over-year comparison. And that inventory rises directly tied to the rising cost of buying homes. According to the national association of realtors, buying a home in June was about 80% more expensive than in June of 2019.

R.J. Cox:

That means a quarter of home buyers that purchased three years ago, would’ve been unable to do so today. And so what we have a risk of now is a possible reduction in lending were not currently a reduction in pricing home prices that went up in June are whopping 13.4%. And like you mentioned, for the past two years, it’s just [00:06:00] been a roller coaster ride up. So adding that is interesting while days on the market still do continue to get reduced in June, 2021, it was 17 days on the market. May of this year, 16 days on the market. And now June has been reported 14 days on the market. And in turn we’ve seen rental prices also increasing 6.7% year to date. And that’s [00:06:30] also expected to continue to increase. As many folks that were looking to buy are, turn into rent, trying to wait out the high home prices and the relatively high interest rates. And unfortunately as rental competition increases. So will those rental rates right now, the current median rental rate in the us is 1362, $1,362. So LaVerne talked to us about foreclosures.

LaVenre Cox:

Well, on the tip [00:07:00] of everyone’s tongue, is the concern about the possible increase of foreclosures, and a possible return to the 2008 market crash. Well, let me tell you, folks, the foreclosure rates have reverted to pre-pandemic levels, but they have not even come close to what a bubble could be signaling. As of yet, the first half of this year, we saw a total of 164,000 plus properties that [00:07:30] entered into foreclosure. That’s a normal rate prior to the pandemic. And as foreclosure concerns continue to rise, there is, however, a side to this that most people are not aware of, but most Americans have about over $180,000 in equity in their homes. And so fewer people are being forced to either liquidate if a personal financial or a capital [00:08:00] situation would be to occur. So the need to liquidate an asset as well, foreclosure is less likely to occur, and what’s more likely for the, at least the end of this year is that more homes at risk of foreclosure will instead begin to enter the market as new inventory and fewer buyers in the market may drive down prices regionally in certain areas, but this will not [00:08:30] directly impact inventory.

We can look at the market over the next few years, borrowing any additional pressures from recessions and recessionary, pressures due to the value of the dollar. We are not necessarily looking at a 2008 crisis, not at least in the next quarter. However, over the [00:09:00] past quarter, there have been signals that recession is on the rise. And generally, our recession is signaled based on two negative quarters or consecutive negative quarters of gross domestic product. And we have had over the past two quarters. So everyone has reason to be concerned, but there is hope in the market. And so we are really here today to kind of tie together how [00:09:30] the current inflationary risk actually prepares homeowners for a wealth opportunity. RJ, would you like to share some of the hottest residential markets where people are focusing on their investments on?

R.J. Cox:

Right. So we all know that real estate is all about location. There are certain areas that are hotter than others, Riverside, California, tops the list. Boise, Idaho is an interesting [00:10:00] second. Then we’ve got Florida coming in with Cape Coral and North Point, and then we’ve got our Las Vegas, Nevada location. And in short, all of these hot markets are all about supply and demand. Many folks rush to these locations with the rise of remote work and specifically in the case for Boise, Idaho, relatively cheaper prices compared to the other metros that allowed one to work from anywhere with fast [00:10:30] internet and a great view. Now, since rising mortgage rates don’t allow the same monthly budget to stretch the purchasing power of the first-time home buyer, the main contender nowadays is our trade up or move away buyer, someone that’s looking for a new dwelling using the proceeds of a prior home sale or a corporate relocation package to help close the deal. LaVerne, would you love to talk to us about why that’s the case?

LaVerne Cox:

[00:11:00] Well, the reason that that’s the case is because as I mentioned earlier, the average American has quite a sizable portion of value that they’ve acquired due to the rise in home prices and on the value of their homes in equity. And as a result, more and more Americans are looking to stay in their homes. And with this equity, they can really establish an opportunity to, um, double down on increasing their [00:11:30] equity. And that’s really what we would like to talk to you about today. We would like to share with you why investing in home ownership is the number one way to acquire wealth. And it really kind of provides some additional guidance as to how to go about doing so in your personal portfolio. So home ownership is the number one way to grow wealth in America, it has always been. It’s not owning a business, it’s not stocks. The number one way is through the wealth creation process of [00:12:00] owning a home. And one of the reasons why investors have a long seen real estate associated…

R.J. Cox:

So one of the reasons why investors have long seen real estate as [00:12:30] a great investment strategy is that you can make money in a lot of ways with strong and consistent returns. Some of the main reasons that people do choose to invest in real estate are America’s cultural values, the American dream of opportunities, self-determination, pulling yourself up by your bootstraps and that personal wealth creation. Also, it’s like LaVerne mentioned the number one ma way to maintain financial security for your household [00:13:00] and family, leaving a legacy. And then, looking at the size of the opportunity. There’s a huge potential here. Forbes has the residential housing market at a $31.8 trillion market. That’s one and a half times the gross domestic product of the United States. And that approach approaches three times that of China.

Krista Westfall:

Let’s move on and talk about the different ways that people can [00:14:00] make money by investing in real estate. And then we’ll go into house hacking and what that means and how it can generate additional income for homeowners.

R.J. Cox:

Absolutely. So we’ve heard time and time again, there are so many different ways that you can leverage real estate. You’ve got property appreciation, all this equity that’s being found in the last couple of years speaks to that story. You’ve also have passive income opportunities [00:14:30] where you can rent the property or have other ways to generate revenue for that property, which produces a stable cash flow that you can utilize to pay down your mortgage and take advantage of certain tax benefits that benefit the property owner. Then you’ve got diversification where you assets in real estate and in possible other asset classes, like stocks or bonds. And then utilizing leverage, for example, [00:15:00] using a mortgage to buy more property. And you’ve got cash to help you to take what you’ve got in hand and use it to make more of a return on investment.

Krista Westfall: Cool. So let’s move on to house hacking. What is house hacking? How can we make money by hacking our homes?

R.J. Cox: [00:15:30] All right. That sounds great. Definitely an area where LaVerne is an expert, but I’ll start while she’s coming online. For the home ownership experience to make money for you, one needs to begin with the end in mind. To build a vision for a goal, you sometimes need to clear the path. With that, some commonly held beliefs have made dreaming of that vision impossible. One popular misconception [00:16:00] has been: this isn’t for me. Homeowners now more than ever need to believe that wealth can be an end goal. We have sometimes heard that home ownership is for someone else. Or you may have heard that my home is an asset, which makes it seem that it is already an investment and you don’t have to do anything at all to make it what it already is. For others who may have heard that it’s a liability, you may presume that it will always be that way while [00:16:30] you have a mortgage on the property. But what’s missing is the basic understanding of investing. Investing is a financial process that yields a return of your principal and the equity and interest from this investment activity. For most homeowners, they went into home ownership without the basic knowledge that they could, in fact, make it an investment based solely on the process for how that property would pay for itself.

[00:17:00] So let’s begin with the goal that your home will pay for itself. Write down that number of what needs to be paid for to make it equity represent 100% ownership of this property, meaning it’s debt free, calculate everything, the ongoing maintenance, the carrying costs, everything that goes into your ownership experience to make sure that the property is paying for itself. Add that to your 100% equity number. [00:17:30] That number you have in front of you is your end goal. LaVerne, welcome back. Would you like to talk about why that’s the goal?

LaVerne Cox:

So, the goal, okay. So it’s the goal because it’s not a mystery why certain people do have great success in real estate. It really is a cause and effect type of investment. For the most part, [00:18:00] those who realize gains and wealth, they do so through the most popular way, which is setting a goal that they can acquire many can do the actual payoff of their asset that they’ve invested in within the first seven to 10 years. And if they envision the end goal, then they can also position the process. So what we would come alongside the end [00:18:30] user to do is working with a monthly that monthly liability and sharing with them ways to not necessarily look at it as an expense that they have to cover, but as an opportunity for them to create either cash flow or a secondary means of appreciation to pay down that debt that they may have on the note on their home.

And then secondly, raise the equity balance, [00:19:00] thereby transforming their personal wealth. So to begin with that end in mind picture, you need to have a vision of where you’re going so that we consider the goal and the method where you are going to utilize this set process is a set process. We provide some wisdom either through data strategies and that wisdom is knowing when to take option A versus B. The history in each of [00:19:30] the markets that your home, your residential property resides already has proven data points that can point to exactly what actively is occurring in the market, both on a macro and a micro level. And it is through the Evergreen Investments platform that we provide the means for you to execute very strategically on that process. The final piece of this is the fuel. One of the things that we want to share with anyone [00:20:00] that participates in an investment is that you’re not going to see your harvest the first day you plant your seed.

So to stay the course, we provide an ongoing incentivized discipline process. So you are consistently being connected to ways to either make money or save money during your process of home ownership, thereby directly impacting the amount of equity that you can’t obtain a return from [00:20:30] your investment in real estate. So most people, I may not know this, but I’m a nerd at heart. And did you know that the history of both mortgages, insurance, as well as real estate contracts all began with the agrarian society. So if you were to establish a system of remembering back to when it was that all society members participated in the growth of, and [00:21:00] the wellbeing by just planting something, I want you to like take on that concept and begin to envision the act of planting. So today, if you planted an apple seed, obviously you’re going to expect an apple tree.

Well, the act of actually investing in your home is a direct tie into the stabilization for your community, the personal wealth creation for yourself and your home and your generation. But [00:21:30] also it also produces a long term effect to the economy. One of the things that we touched on previously was that the size of the American residential value is about 15% of our gross domestic product and being $31.8 trillion in value. Our individual discipline to maintaining the process of wealth generation directly ties into the sustainability and the growth of America as a whole.[00:22:00] So this is one way that you can ensure that not only can you reap what you sow, but you can also reap a return that can tie into the lifestyle and the economy and the values that we all seek to support. So the more you know what to do and thereby do it, the more you can earn. And this is the knowledge with action that we call wisdom, and that [00:22:30] wisdom is the missing real estate advisor system that Evergreen Investments provides. RJ, would you like to share one method of how we provide guidance to real estate investors called house hacking?

R.J. Cox:

Absolutely. So when we’re talking about house hacking and the three ways that you can make money through home ownership this way, we’re talking about using the property that you live in to create [00:23:00] cash flow without having to sell your property and trying to reinvest your equity. House hacking simply refers to finding ways to generate income from your home. You can do this from rentals, renting out a room, building an ADU or additional storage space. You can use your site as a movie or a location site. You can also utilize that space as area where [00:23:30] you can operate a side or a large business or rent that space to another business. There are a lot of finished basements or additional acreage in the back of your property that can be utilized for something else. I know quite a few people that have done bouncy houses on all kinds of fun stuff, just using that spare backyard.

What else could you do with that space to bring in some additional money. Thinking not too long ago, the land housed the business, the residents was [00:24:00] shelter so that you can get back to work the next day. Think of the family farm, the store with an apartment overhead, the end with a spare room for the owner, the business paid for the real estate, not just the owner, paying for the shelter. Everything we still do in this country is about land ownership and entrepreneurship. All we need to do is rethink how we use those principles in today’s circumstances.

Krista Westfall:

So, you know, [00:24:30] house hacking is such an interesting concept that I had never considered before joining this team. And the different things you can do just to generate a little bit of income to help pay down your mortgage are insane. So, if anyone is interested, we actually have a really nice article about this very topic. If you wanna learn a little bit more about house hacking, send a chat, I’ll get that back to you after this webinar. So let’s move on to some common misconceptions. You know, there are a lot of misconceptions surrounding real estate [00:25:00] investing in home ownership as a whole. So I’m gonna ask you guys to clarify some of the misconceptions that we hear on a regular basis. The first one is that right now is a bad time to buy a home. LaVerne, you wanna take this one?

LaVerne Cox:

Sure. Right now is a bad time to purchase a home is really the concept that may be spreading in the airwaves due to fear [00:25:30] of a recession. The challenge that you may have in this concept is that one may not be looking at specifically what’s going on in their personal portfolio. What is your, uh, direct ownership strategy? Are you planning and staying in an area for at least seven years? It’s a good rule of thumb that if you are planning to purchase any residential property, that you try to stay at least a minimum of five to seven years, so that [00:26:00] you can obtain the equity that you may have invested at in your ownership period back in a sizable or a good, if not the entire return. A secondary means of why it may not necessarily be a bad time to purchase a home is dependent upon your end goal.

The FOMO, I don’t know if you’ve ever heard of it, F-O-M-O, fear of missing out. For a lot of people, they [00:26:30] feel like the good times have all gone. The low interest rates that everyone was talking about may never turn back up again. And so instead of putting their feet in the water and learning and getting acclimated to this climate, they automatically think, well, it’s no longer going to be as easy as it was before. But what you may not necessarily see is that this is actually an opportunity with rising recessionary concerns, the [00:27:00] value of stable assets, like a home actually does tend to rise. So even though there may be concerns about either recessionary or concerns about the value of our dollar or economic systems, there is consistency in actual owning a home. And if you compare the cost of ownership versus rental prices, especially in this time period, the cost of ownership is really going to [00:27:30] be actually lower right now in comparison to renting. So regionally, I would say, no, it’s not a bad time to purchase a home. It’s really just based on your personal goals and where you are expecting to see yourself within five to seven years.

Krista Westfall:

That’s awesome. Fear really drives humans. So, you know, it’s nice to hear that those fears can be subdued, which brings us to the next misconception, which [00:28:00] is right now is a bad time to sell a home. So LaVerne you wanna piggyback on what you just were talking about,

LaVerne Cox:

Is it a bad sign to sell a home? Yes and no. I think it all really goes back to it depends on what your outcome and your goal is. So what I said before I got interrupted, due to the internet, the goal really for investing is to [00:28:30] produce an end goal. So if your seed is an apple seed, you want to produce an apple tree. If you are going to sell your home, are you selling your home because you have obtained the goal of what you initially invested in that home for? Some people invest in a home due to, you know, school ratings and they wanted to ensure that their children had a great education. Some people did so for access to a job, and that job is no longer the [00:29:00] focus for maintaining that ownership interest.

So it really does not necessarily mean that it is a bad time, bad for who. So for some people, the judgment for whether it’s a bad time to sell is really based on the economy. As RJ mentioned earlier, today, the cost of homes is still increasing. So no, it is not a bad time. The inventory is still quite low in comparison to pre 2018 levels. [00:29:30] So it is really a great opportunity for you to sell your home, acquire the wealth, if you are planning on either A downsizing or B utilizing a strategy to get yourself into another home or investment in a lower cost or a smaller sized home or smaller sized sheltering opportunity. So [00:30:00] for those who have that option, no, it’s not a bad time to sell the home. It’s actually close to the height of the market. So it’s actually a great time to exit with the equity that you’ve earned. I hope that helps answer your question.

Krista Westfall:

I think it does. I think that covers it quite beautifully. So let’s move on to our third misconception, which is that you should wait until your property is under contract when you’re selling for a home appraisal and inspection. And RJ, I know that you gotta take [00:30:30] this one.

R.J. Cox:

I definitely will. So actually I think that misconception needs to just be banished. Upfront knowledge actually helps you make better decisions. As a property owner, we get so used to the house that we live in, that we are blind to the concerns that another buyer will see when they view the properties with a fresh set of eyes. Knowing what outstanding repairs and maintenance items could arise helps you think strategically about what you’re willing to [00:31:00] fix or give a concession on, or how to price it accordingly if you’re not ready or willing to make repairs. On the flip side, you can also consider making those repairs if you look at the return on investment and that will get you when you and your agent look at what the price difference is, and if it’s worth putting in that extra work. We actually think that getting an appraisal and inspection before listing is so important that it’s actually part of our listing package. We do an inspection [00:31:30] and appraisal before we actively list a property, because we know that being certain of the current physical and financial condition of your asset gives you the owner for knowledge of any concerns that another buyer may bring up and better yet, it allows us to strategize on how to best resolve any of those issues before they arise So we are in a position of strength.

Krista Westfall:

Yeah. And I just wanna highlight that I have eight plus years in the [00:32:00] real estate industry, in this part of the world. And I’ve never worked with anyone who does an appraisal and an inspection beforehand and seeing how we do that at evergreen investments. It makes so much sense from the seller side that we value that so much that we work it into our listing package. So that’s a beautiful thing. So let’s move on to an intro into evergreen investments that missing middle advisor that LaVerne had touched on earlier. LaVerne, [00:32:30] why don’t you tell the group a little more about Evergreen Investments?

LaVerne Cox:

So Evergreen Investments is obviously my passion. It’s one of my pursuits that came from a 20 year career journey that RJ and I personally experienced with home ownership being a catalyst for personal wealth creation. And then secondly, a means for stabilizing communities. So everything that we talked about today thus far is about how to grow [00:33:00] your wealth through home ownership. But that’s part of what we do at Evergreen Investments. What we really do extensively is provide the missing middle advisor experience to homeowners and investors about ways to make money, save money, and invest their money in residential real estate. There are so many providers in the market right now that can assist you in purchasing a home or selling a home. But everything during [00:33:30] the investment experience from when is the best time, what is the best vendors, is my cost on average good.

Should I refinance, is my equity growing at a benchmark or a normal rate? Could I possibly increase my investment outcomes? Should I be reinvesting my money into [00:34:00] more real estate? Or are there possible additional investment strategies that I may not necessarily know about that you can provide additional guidance into? And really that is what we do. We, as the missing middle advisor experience, professional come alongside the homeowner and the investor to provide both a real estate agent’s perspective, but also access to professional advisory services [00:34:30] that help in the asset management, property management experience as well. And the client journey through home ownership as a wealth creation tool, where many people tend to make most mistakes, evergreen investments’ client sees opportunities to make more money. The advisor oftentimes is often missing in more mortgages, advisement, insurance, [00:35:00], and as well as just when to exit or enter a real estate contract, because the industry is not created to ensure that advisement is provided for residential assets.

However, in larger asset groups, mainly commercial real estate, that advisor is a necessary component. What we’ve found is that as the cost of home ownership in America has risen and [00:35:30] the average cost of a home is now, well over $250,000 nationwide, there is a growing concern to know where am I putting my dollar and how should I best be advised in regards to the basic financial education to ensure that the dollar that I just invested becomes part of money in my backyard experience versus, if you guys are a member, the Tom Hanks’s [00:36:00] story of the money pit. And so what we do here at Evergreen Investment is to come in assist and guide through data strategies, and professional support, services to the connected, systems and tools to ensure that your experience is one where you are winning consistently in the investment strategy and journey as a homeowner.

Krista Westfall: [00:36:30] Since in it you touched on it a bit there, but do you wanna talk any further about how we support homeowners at Evergreen Investments?

LaVerne Cox:

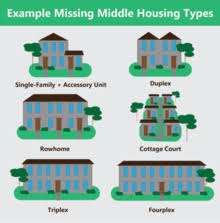

Sure. One of the things I mentioned earlier is that in commercial real estate, for example, their advisory component of that service normally has direct tie into data, it has direct supports that are [00:37:00] provided to a real estate investor or a commercial property owner as just part of the average everyday experience. The difference for a homeowner is that they are not being shown that data that shows what is going on in their market. An example is how many investors are actively becoming your neighbors? How many of the properties in your area are [00:37:30] becoming Airbnbs? What is causing the rise in the rental increase in your market? Is it due to attractions in your area, or is it really a short term need that needs to be fulfilled as there is a missing sizable unit, residential unit, mix, that is not currently available.

And so what we do is we provide that data. So you can [00:38:00] see what is causing the home ownership opportunities and the risk in your local area. The second aspect of what we do is we provide you with a step-by-step strategy. The means for the effect that we all want in the home ownership journey, which is to ensure that that money that I just invested in my home does return to me, or at least a consistent [00:38:30] return to me is really done through time tested, money approved, personal finance strategies. These are not, you know, run-of-the-mill ideas that we are coming up with. Every aspect of residential real estate utilizes these techniques. It is just becoming more aware and making sure that these strategies are part of your home ownership experience causes the effect of turning [00:39:00] your home ownership note experience from a monthly liability to a monthly growth asset. And so that’s exactly how we tie in the investment experience of home ownership through the Evergreen Investments platform.

Krista Westfall:

Awesome. Well, that was really good stuff, guys. I wanna move on to the Q&A because we’re coming near the end of our time and I wanna make sure we get some of those questions [00:39:30] in. Start with one of the most popular questions we get, and that is how does someone work with Evergreen Investments? RJ, would you like to take this one?

R.J. Cox:

Absolutely. So it’s really a three-step process and it revolves around a series of conversations. You meet with an advisor and we understand your goals, the situation that you’re have with their property or [00:40:00] what you’re looking to do as you’re looking to buy a property, we figure out a plan of action, and we put together a statement of work. We’ll review it together, talk through the details, make sure we’re on the same page as to what we’re looking to accomplish together. And once that agreement is finalized, we’ll have a service contract. So you know exactly what to expect from us at Evergreen Investments. And then you as a property owner or the prospective owner know exactly what needs to be done on your side so that we are both working together to [00:40:30] that same common goal.

Krista Westfall: Awesome. And then you watch the money flow in. All right. The second question. Do you think the rise in home prices and interest rates we’ve been seeing the last couple of years are a bump in the road, or are they here to stay? What should I do if this is the new normal? Let’s cover that one over to LaVerne.

LaVerne Cox: It’s not a bump in the road. This is part of [00:41:00] the normal real estate cycle and what you do now depends on your plans and your resources. So let’s talk a little bit more in detail about that by scheduling an appointment with an advisor. But regionally versus nationally, the economic impact happening on the national level is going to impact the state. The state economic activity is going to impact regions. And as a result of the regional economic activity, it will trickle down to cities and sub areas within our [00:41:30] cities. So how your asset performs is really viewed in terms of those values and risk and opportunities that are directly connected to the macroeconomic factors. So part of ensuring that your outcome is more consistent is knowing the cause, as I mentioned before, and the strategies to obtain the effect that you desire.

Krista Westfall: All right, then. Third question. Does it [00:42:00] make sense to pull equity out of one property to use as a down payment on another? Who wants to take that one?

R.J. Cox:

Take that one. So if the new property that you’re looking to buy will bring in much more income than the proposed debt payment. We could look at that as a cautious, maybe we’ll work with you hoping for the best while planning for the worst, that will help us to cover much [00:42:30] of what could possibly go awry, but we definitely wanna sit down and consider all options before we make that decision at the end of the day. We’re building a financial platform for the long term. So we wanna make sure that what we’re doing covers as money vis and reward opportunities as possible.

Krista Westfall: Awesome. And then our fourth and final question. How much money should you put aside for maintenance costs for a rental [00:43:00] property? And I’m pretty sure this is an RJ question as well.

R.J. Cox: It is. it’s one of those things that I have a lot of conversations about. You’ll hear a rule of thumb that says you should put aside 1% of the assets value. And so you’ve got a house that’s $100,000. You put aside a thousand dollars every year from maintenance. Now, if you’re an owner occupant and you’re covering basic maintenance, you can get away with a thousand dollars [00:43:30] just to fix a couple of locks or a window screen, something like that. That’s relatively minor. The challenge is that if something fails, if something breaks, think of your AC units in the middle of summer, or furnace in winter, that thousand dollars just is not going to cover it. And especially nowadays with the way these equipment prices are going up, the minimum recommended is $5,000 and it seems to be a hefty number. But when you think about what it takes to sit there and get a qualified [00:44:00] professional and qualified systems in there to make sure that what you bought today will last rather than trying to do it cheap and have to do it again in six months, it’s worth it in the long term. Remember we’re building for the long term. So $5,000 is where I would advise most clients to put aside.

Krista Westfall:

It sounds like a small price to pay for some major issues to happen in the future.That brings us to the end of our [00:44:30] time. Thank you, LaVerne and RJ. As usual, you brought the heat, you brought us some great information. Another big thank you to everyone who joined us today for our very first webinar. We appreciate you sticking through the kinks of a couple of technical issues. But we’re appreciative of you guys joining us as we begin this journey, like I said before, you’ll all be receiving the recording later today to refer back to if you would like. One last thing I wanna let you guys know about, we are releasing a new [00:45:00] product in about a month and everyone who is in this webinar will receive a code to get that product at a great discount.

It’s a market report product that will teach you how to increase equity, reduce expenses, and it’ll teach you some income generation strategies for your current property. It’s a very good product. So you will be getting that code in the next couple weeks, if you would like to get that property report for [00:45:30] a lower fee, if you will. So thank you all again, be sure to check your emails for the recording and please follow us on social media to stay up to date on all things, evergreen investments. We hope you join us again next month to continue our journey to growing wealth through home ownership. Thanks guys.

0 Comments