Let’s take a stroll back to a time in our lives that we don’t remember fondly … microeconomics class. Picture it. You walk into your classroom and see those three words on the board: Supply and Demand. The idea seems intimidating at first, but in reality, the concept is simple. When supply is low, demand is high. That’s it. This lesson is driving the conversation of the current residential real estate market. We’re currently seeing a large demand for homes, but inventory (aka supply) is at historical lows. So what is the impact of housing demand outpacing supply?

The Recent and Current Markets

It’s a fast-moving market. If you’ve been watching the numbers, you’ll know that supplies are low and demand is high. If a house comes on the market, it sells quickly. Even dilapidated homes or properties in need of a major overhaul are selling fast and at big, even outrageous prices. Realtor.com reported that the typical time a home spent on the market in January 2022 was 61 days. According to Danielle Hale, the company’s chief economist, this is faster than any January recorded before the pandemic years.

Throughout 2021, the pace of buying began to build while the supply of houses dwindled. Growth in the real estate market is natural and expected as properties are assets that can gain value. Because of a combination of supply, demand, and low interest rates, buyers have been slugging it out over residential properties and driving the prices even higher. However, things began to shift into unprecedented waters in late 2021. Mortgage rates started climbing in December 2021. Freddie Mac reported a high of 3.92% in February 2022.

Throughout 2021, the pace of buying began to build while the supply of houses dwindled. Growth in the real estate market is natural and expected as properties are assets that can gain value. Because of a combination of supply, demand, and low interest rates, buyers have been slugging it out over residential properties and driving the prices even higher. However, things began to shift into unprecedented waters in late 2021. Mortgage rates started climbing in December 2021. Freddie Mac reported a high of 3.92% in February 2022.

These higher rates were sufficient enough to shut out many buyers. We saw unprecedented competition and rapid exchange throughout January 2022. Rising mortgage rates pushed buyers to move even faster before mortgage rates rose once again.

In addition to this whirlwind of activity, home prices are outpacing wages more than before. This is a trend that perplexes housing economists and upsets potential homebuyers. The disconnect between housing prices and wages is a hot topic right now and one worth investigating.

Who Is Affected in the Current Market?

When wages aren’t rising to equitable levels, many potential buyers get locked out of the equation. Who will or won’t be able to purchase becomes a concern. For these people, owning real estate becomes a more and more difficult goal to realize. Unfortunately, low-income buyers are quickly being locked out of the opportunity to own their homes.

Existing homeowners who aren’t seeing an increase in pay also play a role in this scenario. Those who have mortgages from before the recent rate hike will be paying far more to rehouse their families should they decide to buy and sell. New listings dribble in because current homeowners are not enamored of paying more for debt they are already managing. This keeps supply down, which is great if you want to sell, but not if you are looking to buy.

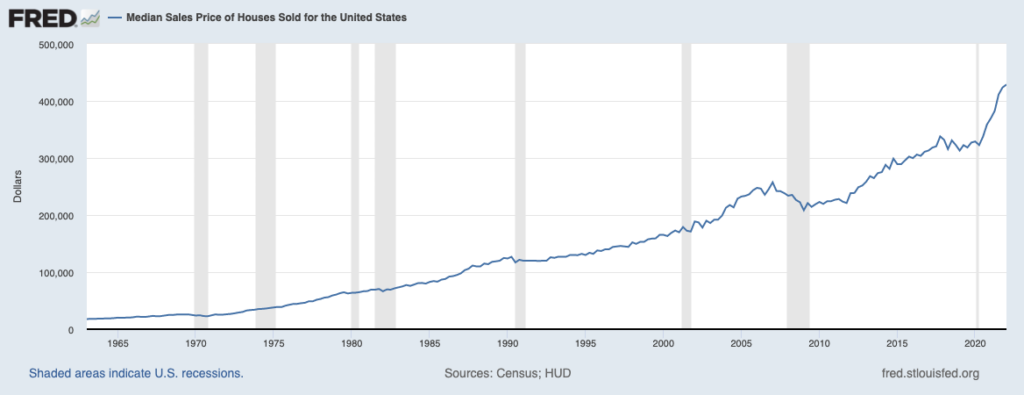

The median household income in the United States in 2020 was $67,521, a decrease of 2.9% from 2019. The median price of a home in the United States at the end of 2020 was $358,700 and, by the end of 2021, the median home price had risen to $408,100.

In order to buy, a down payment and the ability to qualify for a loan are required. A 20% down payment on a median-priced home at the end of 2021 would be $81,620. Fool.com points out that “…home prices have increased 7.6 times faster than income since 1965 and 3.1 times faster than income since 2008.”

The Immediate Future for Buyers

Eventually, the market will settle. As more inventory is added, demand will even out, and home prices will be poised to stabilize. However, we may not see inventory rising until late in the year or into next year. Even in our current market, it’s still possible in some communities to purchase a home with a median income, but the down payment can be a difficult hurdle. To close the divide for low-income buyers, wages must rise, and options for down payment support must be put into place.

For those who own rental properties, rental housing demand will increase, and rental costs will, too. Owning rental property is a hidden opportunity for investors and buyers right now.

The Impact of Home Prices Outpacing Income

Workers help build a foundation for growth and general prosperity for all of us. Stagnant wages slow migration and job growth. Many working people can’t afford to move to locations where jobs are plentiful and wages are better. The incentive to create entry-level homeownership opportunities slows as do overall economic growth and affordable housing options.

What You Need to Remember

Buying real estate is always a good investment. Instead of hesitating to buy or sell, seek out facts regarding the current market, and don’t make assumptions. This approach arms you with the right information to plan your next step.

Indicators for current market supply include:

- Construction completions

- Housing starts

- Number of permits issued

Indicators of market demand take into consideration:

- The number of days a house is on the market

- Home prices

- Actual sales

- Inventory on offer

Local Markets and National Statistics

Not every market has responded quite as dramatically as the national average indicates. National averages combine all states to calculate median numbers and identify general trends. Some states don’t come close to meeting these averages. However, all markets will show some signs of the trend. You’ll find an increase in prices and demand while seeing a drop in inventory.

Watching national trends is important but not as important as understanding the local market. Seek out data that is specific to the state and city in which you want to buy. Poring over local real estate market reports can be helpful. Keeping track of market developments is key for investors, landlords, homeowners, potential buyers, and those building real estate portfolios. Opportunities to optimize homes and rental properties are available.

Historically, strong real estate markets show values rising depending upon an area’s economic condition, job availability, visual improvements, mortgage fund availability, and the condition of the homes listed. Building a new house is an option to explore, but supply chains may slow your progress when it comes time to start construction. Do your research to decide what risks you’re willing to incur.

If You Want to Buy

Know what you want before you start shopping. Planning is your best tool for real estate success. You must understand what is needed to move quickly and snag a great property. Hesitating can put a fast end to the buying process and leave you feeling frustrated. You’ll likely be faced with a bidding war in some markets, so be prepared to go higher if you see a good value.

If you want to buy in this economy, having a strategy and a team is ideal for optimal success. Like every industry, the housing market has a supply chain, and having partners that can position your interests earlier in the supply chain will optimally equate to more options to execute and win a successful bid on a new home. In many instances getting ahead of the many players in the market can also lower your costs and reduce your barriers of entry. Evergreen Investments is a residential supply advisor. We support our clients in locating, analyzing, and acquiring access to hidden inventory before it being offered in the open market.

Buy properties for rental and resale potential, and be smart about remodeling. Supply chains have struggled, but many of their issues are being solved. Look for sound yet economical and environmentally friendly ways to improve the property. What people want in a rental is changing, and you want to attract a good tenant. Responsible renters add value to your real estate investment.

As always, discerning what you want from the current market is a good starting point when buying or selling during unprecedented circumstances. At Evergreen Investments, we help our customers invest, buy, sell, rent, and optimize residential properties. Call us today to learn more about our services.

0 Comments