Despite a slight increase in the supply of available housing and rising mortgage rates, home prices across the country have continued to increase in 2022, building on trends in 2021. Higher housing costs may have slowed the rate of mortgage applications overall, and some experts are concerned about a general decline. When planning to enter the real estate investment market, it is important to understand trends and general directions in home prices. By looking at changes in the market between 2021 and 2022, we can better prepare for future market trends.

The Changing Housing Market

During much of 2022, home prices have consistently climbed, reaching a median home price peak of $413,800 in June. While the median price fell to $389,500 in August, this was still an 8% increase over 2021 prices. The Mortgage Bankers Association noted that while prices remain high, overall new mortgage applications are in a decline, reaching their lowest point in 22 years. They cite the higher cost of housing combined with more households’ tight financial situation as a reason for the decline in new applications.

As the economy has changed overall, so has the housing market. Realtors report that buyers and sellers are entering more protracted negotiations over home prices. Many sellers are raising their prices, but others warn about the risks of leaving homes on the market for an extended period. However, the sellers’ market may be coming to an end as an increasing number of buyers seek discounts, repairs and solutions for problems in their properties before agreeing to a deal.

Changing mortgage rates, affected by overall interest rate hikes, could have a significant effect on the market. In January 2022, mortgage rates hovered around 3.1%, while they reached 7% in October 2022. This means that home buyers now can only afford a less expensive property for the same amount of money. Interest rates may decline again as inflation slows; however, they could be hiked up again if prices overall continue to soar.

Economic Uncertainty and the Real Estate Market

Overall, the U.S. Gross Domestic Product (GDP) has been in mild decline for the past two quarters. The GDP measures the value of goods and services produced in a country. The metric is generally used as an indicator of the overall economic health of the country. The decline in GDP in the second quarter of 2022 was less severe than that in the first quarter, with better results than many people expected.

Still, there is a good deal of insecurity about the economic climate. The general definition of a recession is two consecutive quarters of negative GDP growth. However, some say that a recession requires a significant decline in economic activity that lasts more than a few months. This means that the second half of 2022 will be critical in determining the current state of the U.S. economy, including the real estate market. There remains strong growth in the labor market and corporate income, pointing to economic positives amid an overall slowdown.

This economic uncertainty is combined with inflation even though there are few signs of layoffs and a significant number of available jobs. Overall consumer sentiment remains positive, even as stock market declines have been significant. While economists at Fannie Mae say a 2023 recession is likely, the Mortgage Bankers Association (MBA) sees the chances of a recession as 50/50.

Real estate is often one of the safer economic assets in a recession, although this may vary significantly depending on whether a real estate bubble is part of the economic crisis itself. For example, the 2008 economic crisis developed from significant problems in the mortgage market, including the widespread use of subprime loans and their repackaging as further investment vehicles.

How Does This Affect Home Prices?

Still, home prices are not showing signs of further significant change. Experts at Fannie Mae expect that home prices will continue to rise, with a 16% increase predicted in the coming quarter. They expect that 2022 home prices will settle at a 9% yearly increase over 2021, with a slight decrease to come in 2023. Fannie Mae forecasts that house price growth will turn negative beginning in the second quarter of 2023.

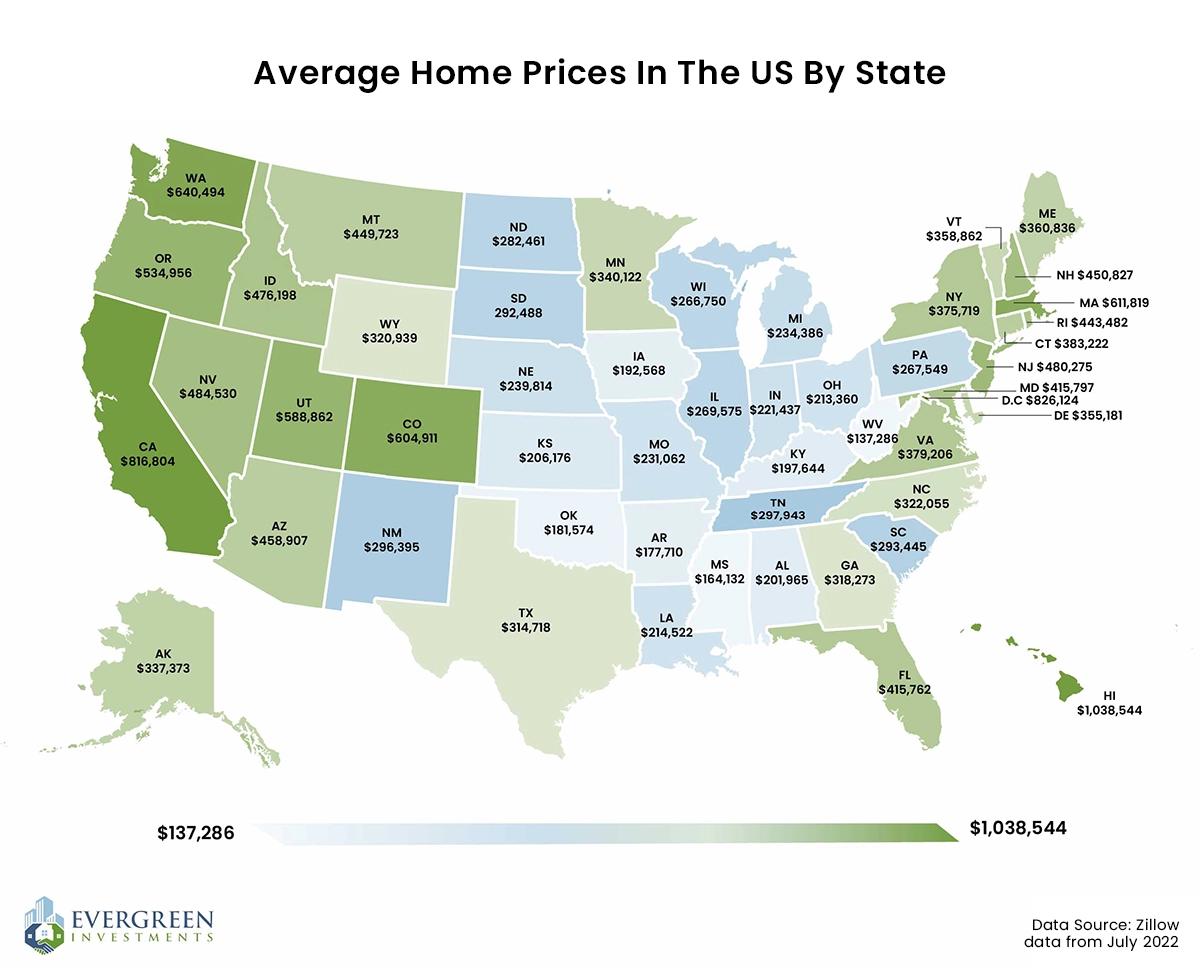

There is a faster rate of decline in some large and desirable cities, such as San Francisco, Seattle and San Jose. This may be because of their very high initial prices where unaffordability combines with rising mortgage rates to put the brakes on new purchases. In markets that deviate from the peak of national prices, the effects of rising mortgage rates on overall home prices may be much more limited. However, some high-demand pandemic markets like Phoenix and Las Vegas are also seeing decreases in home prices.

Of course, the supply of available homes has a major impact on pricing. When homes are scarce, it can be far too easy for buyers to enter bidding wars. Investors may tend to avoid these types of properties, looking instead for less competitive properties with a greater potential for significant future appreciation.

In August 2022, inventory was over 26% higher than it was at the same time in 2021. There were also 13.4% fewer new listings at that time. Some owners are reluctant to put properties on the market, given the persistence of homes already for sale and the rise in mortgage interest rates. The overall inflation and consumer price increases have also reduced buyer interest in large purchases. Many sellers may hope for a decline in mortgage rates to spark buyers’ eagerness for their properties.

Deciding Whether — and What — to Buy

As a real estate investor, you may be determining whether or not to buy in the current housing market. Keep in mind that, in any market, there are advantageous properties to purchase and more challenging opportunities at the same time. Budgeting and considering the future upside of a property are important for investors, who are looking beyond the sentimental draw of personal home characteristics. It is still largely a sellers’ market although that advantage has declined from its 2021 peak.

While there have been declines in home prices, they are still higher than they were one year ago and higher still when compared to 2019 pre-pandemic prices. Real estate is very local and seasonal, and many tend to buy larger homes in the spring and early summer, with residential buyers looking to move between school years. For investors, the timing of a purchase may be less of a concern, and they may want, instead, to look for seasonal deals. For example, sales of smaller, less-expensive homes, ideal rental properties that tend to sell in the fall and winter, skew prices lower during these seasons.

Experts also note that traditional vacation rental markets, popular with investors entering the industry, are expected to see ongoing price increases. While the residential home market will be affected by the annual slowdown in the winter for real estate, these properties continue to have much lower supply than demand. In short, the decision of whether to buy now or wait depends on your location, type of target property, access to financing and future expectations for the market.

2022 and Beyond

Paying attention to market trends is important for your success as a real estate investor. Another key strategy that can help you succeed is by consulting with experts, like the real estate management services at Evergreen Investments.

At Evergreen Investments, we connect investors and homeowners to opportunities for building wealth in the real estate investment market. We aim to help all our clients reach their goals and succeed. Our services include investment real estate brokerage, investor support services, and property management. For investors, we can help you to identify and bid on desirable properties and enhance your portfolio. For homeowners, we can locate a property that fits your needs, but will also grow in value. Visit our buyer’s page to learn more. To discuss your options and opportunities with a Real Estate Investment Advisor, schedule a discovery call today.

0 Comments